THE PANDEMIC HAS ALTERED YOUR M&A OPTIONS

The bottom has fallen out of the tech M&A market. Service providers that can provide adjacent services are aggressively doing so; instead of working on deals, lawyers and accountants are preparing SBA loan applications for their clients. As closings wane, M&A advisory firms that rely primarily on retainer fees have shifted their attention to marketing in an effort to sign new clients. Already faced with tough decisions, founders, executives, and investors must also navigate the noise and hype that reverberates through a disrupted market in order to understand what is actually happening, and to make correct decisions regarding M&A.

As leaders in the sub-$100 million tech M&A market for two decades, veterans of two global economic crises, and lead advisors in over 100 transactions, we have a perspective that may prove useful to elite leaders who intend to create the best possible outcome for their teams and shareholders.

Our view is presented in four parts:

1) The impact of the pandemic and ensuing economic crisis on the tech M&A market;

2) M&A activity pattern matching – financial crisis, dot.com, and Covid-19;

3) Some companies should sell now – are you one of them?;

4) Eight strategies to adopt now that will build value and ensure long-term success.

1) The impact of the pandemic and ensuing economic crisis on the tech M&A market

Let’s start by examining the common wisdom in favor of steady or increased M&A activity during an economic downturn – the messaging that you will hear from service providers seeking retainers:

a) In January 2020, public companies and institutional investors had more cash available to invest than in any other time in history. They still do. Crisis aside, don’t they still have pressure to use their cash to buy companies?

b) In the latter years of the economic cycle, public companies turned their focus from M&A to stock buybacks, pumping record amounts of cash into shrinking their share count and amplifying share value. Now that they are being widely criticized for this practice, won’t these companies have to return to the M&A market?

c) Valuations are down and every company is on sale. Shouldn’t rational buyers increase, not decrease, their M&A activity?

There is truth to these statements. There is a lot of cash in the market, but it is seeking safe haven, not risky tech bets. Companies are under pressure to do deals but will be rewarded for opportunistic bottom-feeding, not strategic gambles. And yes, valuations are down, but few high quality companies are actively seeking to be acquired. As a result of these trends, we’ve seen M&A activity slowing down. Additionally, there are other downward pressures on M&A:

a) Before they can make acquisitions, companies have to revise their own forecasts, “right-size” their workforces, plan for worst-case scenarios, and regain confidence in the future of their own companies;

b) A company that is actively shopping itself today is presumed to be distressed; buyers are now responding to inbound inquiries with “if there are some strong players on your team, we will consider giving them a job.” In other words, in a market crisis that is killing companies, buyers assume, to paraphrase Groucho Marx, that they “wouldn’t want to own any company that would ask to be acquired.” Buyers don’t have time to waste on conversations about big valuations for unprofitable companies. One buyer recently reconfirmed their interest in our client’s profitable, growing SaaS business, and told us that our client stands out from the other pitches they are getting today; for example, the buyer “recently had a management meeting with a company represented by [Top 5 Investment Bank] that is pre-revenue, and looking for a $500 million valuation. We might have taken a closer look in January. . . Not today”. In our case, we had already been in contact with this particular buyer and had established our value as a highly synergistic partner.

c) Leaders are being cautious and are actively avoiding decisions that commit capital. We have one deal where an LOI is sitting on the desk of the CEO of a $12 billion publicly-traded company, awaiting his approval. The deal would consume 2% of the buyer’s cash balance. Even though our client’s business is profitable, resilient, and highly strategic, the CEO is unwilling to approve it. If I were him, I would be cautious as well.

The result is molasses; a slow-moving M&A market with a lot of talk and very little action.

As the pandemic continues, we will see three categories of announced deals: a) deals that were already in flight, and have somehow been completed in spite of market disruptions (often after being re-priced and restructured to meet the new market reality); b) new, often distressed deals that emerged as a result of the economic downturn (for example, the acquisition of Upcounsel by Enduring Ventures, after Upcounsel announced a shutdown date); and c) strategic deals that are initiated during the pandemic. We know these strategic deals are happening because we are initiating them now – but it is absolutely critical that you review and understand the dynamics presented in section three of this article before trying to initiate transactions in the current environment.

Issues that would present minor pitfalls to transactions in a normal market, could now deal death blows in the current environment. There are specific strategies that work and strategies to avoid in a disrupted market. We will get into that later; here, we are focused on the current narrative of the market and the qualitative pressure on companies and executives to avoid risk.

The slowing of the market is reflected in the data:

a) M&A activity closely follows the volatility of equity markets. “From 2000 through 2019, the correlation between the value of the MSCI World index and M&A volume was approximately 80%.” The index rose 28% in 2019 before losing all of those gains and more in Q1 2020. Buoyant stock prices encourage public companies to make deals and take risk. The opposite is also true.

b) Although lower-middle market deals aren’t reliably tracked, they tend to follow the trends in the mid- and large-cap markets, where deal volume has plummeted 51% in Q1 2020, as compared to Q1 2019 A 51% drop year-over-year sounds grave, but The situation is actually much worse, because the true weight of the pandemic was not widely recognized until well into the quarter.

c) Leveraged deals depend heavily on the availability of credit, which cautious lenders are guarding closely. Several years of aggressive lending into leveraged deals resulted in a growing crisis in Q4 2019 as privately held leveraged companies defaulted on loans at 2.5x the rate of public companies. The lending frenzy was fueled by aspirational pro-forma EBITDA projections that were problematic before the pandemic, and are completely unsupportable today. Lenders and the deal shops they support are now, temporarily, closed for new business.

“Alright, got it, M&A has slowed down to a crawl.” When will it bounce back?

2) M&A activity pattern matching – financial crisis, dot.com, and Covid-19

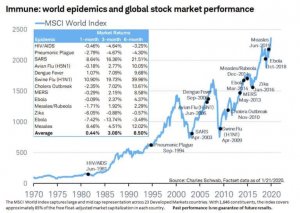

Correlating prior pandemics with markets makes it clear that Covid-19 is different. Recent prior pandemics brought tragedy and fear, but did not shut down entire economies. Charles Schwab published a thoughtful analysis of the impact of prior pandemics on markets, focusing specifically on the time that it took markets to bounce back; the Charles Schwab analysis shows the MSCI World Index actually going up by approximately 0.4% in the month after an epidemic, 3% in the six months following, and 8.5% after a year:

The Covid-19 pandemic has brought equity values down by double-digit percentages, slowed the credit markets, and threatened a liquidity crisis that has resulted in unprecedented intervention by governments globally. We are likely going into a recession. Clearly this scenario has little in common with prior recent pandemics, and is more akin to the dot.com crisis of 2000 and the financial crisis of 2008.

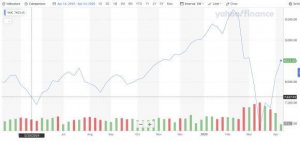

Looking at the impact of the pandemic on the NASDAQ index, we see an initial drop in February 2020 as the virus began to take hold in the US, followed by a steady recovery in April in response to government stimulus and slowed or negative infection / death rates in the initial hot spots.

Looking at the equity markets in mid-April, it would be comforting to accept the up-and-to-the-right trajectory of all major indices as evidence that the impact of the virus has peaked, and that we are several weeks into a recovery. Indeed, the indices dropped at a record pace; why wouldn’t the recovery be equally fast?

However, we are not convinced that lagging indicators have been priced into the equity markets. Specifically, it is unclear if or when the consumer will regain confidence and resume the spending required to sustain our consumer-driven economy. The following data points contribute to our uncertainty:

- 17 million US workers filed for unemployment in the first half of April

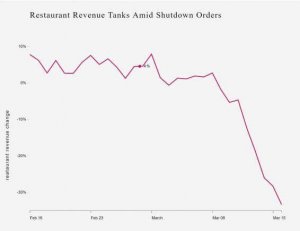

- Lockdown will damage or kill numerous local businesses. For example, 1 in 12 US workers is employed in the restaurant industry. Restaurants have been shut down. Revenue has plummeted (see below), employees have been furloughed or laid off, and many restaurants have insufficient reserves to survive and restart

- People under financial pressure will find it increasingly difficult to meet their financial obligations. Approximately 30% of residential renters did not pay rent by April 5, 2020. Other debt obligations will be even lower on their list as they triage their financial obligations. Meanwhile every category of consumer debt except for HELOCs and personal loans has increased over the last 10 years (Experian).

In short, we expect continued disruption in the financial markets, record unemployment, and a long, hard road to recovery. The recovery cycles in prior crises won’t predict the coming years with certainty, but they do offer clues to the puzzle.

Historical M&A Patterns

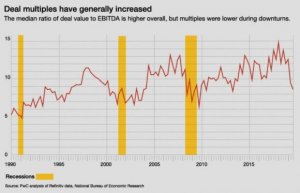

Looking first at valuations, how long did it take valuations to recover, in the broad M&A markets, after the disruptive events of 2000 and 2008? PWC tracked this, using EBITDA multiples across all segments. In both cases it took about 4 years for multiples to reach pre-crisis levels.

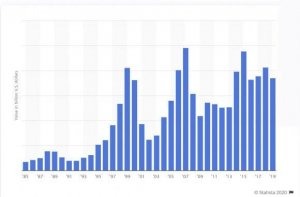

How about deal value? The aggregate value of M&A took 7 years to recover to the values witnessed before the dot.com bubble in 2000 – and then plummeted again during the financial crisis of 2008. Deal value never subsequently reached the level of 2007, coming close in 2015 – 8 years later -before dropping off again.

Value of mergers and acquisitions (M&A) worldwide from 1985 to 2019

US $ billions, Scale not shown

This makes sense; when valuations reach interesting levels, companies start pursuing M&A again and the dollar volume ramps up to pre-crash levels. We should bear in mind that these data track large deals; when dollar volumes surge, we typically find a cluster of megadeals driving the numbers- and the megadeals don’t happen until we are well into a recovery.

In our experience, recoveries happen faster in the lower middle market. Valuations recover faster because strategic acquisitions that are immaterial in size can command higher valuations earlier; when a giant swallows a minnow, shareholders barely notice. By the time the blockbuster deals are pushing deal values to new highs, buyers have already been active in the middle market for some time.

In other words, if the duration of the recovery cycles from 2000 and 2008 hold true in the current crisis, we expect to see middle market valuations recovering in 2-3 years. There are no data to support this assertion, just experience.

It may be helpful to look at trends in the residential housing markets. During prior crises, valuations dropped, the lenders tightened credit, and for a period of time the only transactions that closed were forced sales, or transactions that were already near the finish line when the market turned negative. During prior downturns, financially secure buyers who were just starting their search for a new house were hopeful that there would suddenly be a flood of high-quality homes on the market, at prices that reflected the market reset. They were disappointed. Owners that didn’t have to sell, didn’t. Inventory was largely limited to distressed or oddball assets. The same thing happens in the M&A markets; the high quality inventory stays off the market until valuations come back to an interesting level.

However, strategic deals still happen in downturns. Smart buyers willing to pay a fair valuation can pick the deals they want with limited competition. We are already seeing this dynamic at work, with several highly strategic, uncontested transactions taking shape outside of the drama of a traditional process. In our current engagements, we are laser-focused on lining up exactly the right buyer and creating alignment around deal parameters without running a full-blown process. We would not advocate this restricted approach in a sellers’ market, but it can be an effective, productive strategy in a disrupted market. We explore this further in the next section.

If you have a profitable company that can gain ground on competitors during the current crisis, you should study the strategies outlined in section four of this article and put them to work. One of these strategies is to identify and explore highly strategic M&A opportunities with minimal disclosures and disruptions to the core business.

On the other hand, you may need to sell your company now, irrespective of market conditions.

3) Some companies should sell now – are you one of them?

If your company finds itself in one of the following situations, selling the business now may make sense.

The Case for Synergies:

If being acquired gives you access to additional resources that are required to pursue a market opportunity, or can accelerate growth by combining products, leveraging channels, or via other synergies with another company, then you should explore that opportunity. PWC finds that smart acquisitions completed during a downturn can deliver a double-digit growth advantage over competitors that stay on the sidelines. As a seller, you can potentially capture some of that upside in the form of equity or earnout.

We are currently working on several transactions that meet these criteria. In one case, our client is selling two SaaS offerings into a base of several hundred customers, and the acquirer has a suite of complementary products that are perfectly suited to the same customer base, presenting cross-selling opportunities and revenue-generating synergies. Furthermore, buyer and seller each have vulnerabilities in their customer base, including exposure to the hospitality and travel industry, that are mitigated by the combination of the two businesses.

In a second case, our client offers a trading platform that is perfectly suited to the financial services market on a “work from home” footing, but lacks the brand recognition to be selected as the platform for billions of dollars in transactions – a barrier that is immediately demolished by joining one of the entrenched giants in the industry.

Your decision framework should include the following assumptions:

1) Your valuation will be lower than in a strong M&A market.

2) Your deal structure will be more complex, and may include more contingencies and earnout.

3) Diligence will be tougher, requiring more scrutiny. Every risk factor will get at least one extra look.

4) Your upside, with synergies, could exceed your “go it alone” upside.

The question then becomes, does the upside exceed the hurdles of a tough M&A market?

The Case for Capital to Fund Acquisitions

We frequently talk with founders or executives who have built good tech companies with strong management teams, profitable business models, and loyal customer bases – and are now looking at a landscape of potential acquisition targets. Some of their competitors have a strong core but are struggling in the current market conditions or are being managed by aging, tired owners eager to transition out of the business. These founders and executives should be making acquisitions, but may not have enough capital.

In this scenario, the founders or executives should consider selling a majority stake in their company to a financial sponsor that is ready to fuel the company’s growth and fund additional acquisitions. The management team provides a strategic platform to integrate and grow the acquisition targets while a financial partner brings the cash. Both participants share in the upside.

Yes, in an economic downturn, the initial valuation will likely be lower and a seller would have to give up more equity than they would in a robust market. On the other hand, it will be possible to assemble a bigger, more profitable company, using fewer resources, than would the case in typical market conditions.

The Case for Venture Stage Companies

Your board asked you to burn cash and grow. You were chasing milestones that reflected market reach, not revenue. Cash Flow Break-Even isn’t on the horizon. Suddenly, everything changed; customers and investors retreated, but the burn, well, the burn did not retreat.

M&A is not your top priority. Your top priority is to pivot to cash flow break-even. If you can do that, you may hold enough cards to reset your valuation and raise new capital while clawing back enough equity to make it worth your while. But if that isn’t possible, it is time to sell.

It won’t be pretty. And it will get worse. Time will be your enemy. It will be critical to conduct a quick survey of buyers to find out what they are willing to do. Your board can then assess those options against the tax advantage to shareholders of shutting down. This is not the time to indulge a board member’s fantasy about a strategic sale to Google or Microsoft – unless they are willing to underwrite the business indefinitely.

In these three scenarios it probably makes sense to run a process during a downturn. However, for companies that don’t need to run a process now, it is critical to focus on M&A preparation and value creation during the market crisis.

4) Eight strategies to adopt now that will build value and ensure long-term success.

1) Win by leading

Partners, employees, customers, analysts, and everyone else in your ecosystem are looking for leadership. They are surrounded by fear, uncertainty, and indecision. They will rally behind leadership.

Leadership means making tough decisions and acting on them immediately. It means cutting staff. It means telling vendors you can’t pay them now, but you will keep them in mind as business improves. It means presenting a pragmatic plan for the next twelve months, along with the individual steps required to get there. It means presenting a product roadmap to your customers and prospects that is confident, powerful, and achievable.

The employee who was threatening to leave for a higher paying job is now wondering when you will fire him. The newly-acquired customer is now wondering if they should pay you, because they don’t know if you will still be in business next year. Your landlord is waiting for you to call and explain why you won’t be paying rent this month. In every corner of the world, someone is waiting for someone else to call so that they can then make a decision. The leader who strides through this world with certainty and purpose is the leader that everyone rallies behind in challenging times.

2) Guard Cash

Take advantage of every government program offered to you, starting with the SBA PPP loans.

As we publish this article, several clients have already received millions in forgivable PPP loans. Maybe they are your competitors. The government is investing in business continuity, and you should take them up on it.

Scour payables for non-critical expenses. Pay net 30 invoices in 45. Negotiate more favorable terms. Accept nothing at face value.

Early in the 2008 financial crisis Sequoia published a position piece for their portfolios that was broadcast across the entire industry. It was called “R.I.P. Good Times”. Now Sequoia has released a similar piece predicting long-lasting economic carnage from Covid 19. In this latest publication, Sequoia reminds us that “Airbnb, Square, and Stripe were founded in the midst of the Global Financial Crisis. Constraints focus the mind and provide fertile ground for creativity”.

3) Invest in Strategic Marketing

You may have to cut your marketing budget. You should definitely expect more for your marketing dollars. But there is one area where you should not cut back, and should even consider investing more: strategic marketing – not the hand to hand combat that gets you the next dollar of revenue (which may not be available anyway), but the thought leadership that builds your reputation as a leader in the marketplace.

A dollar spent on strategic marketing in 2002 delivered a multiple of the value of a dollar of marketing in 1999.

Marketing is expensive and inefficient in a booming market. For example, during the dot.com era, tech companies bought billboards along the 101 freeway on the way to San Francisco, bought booths at trade shows, advertised in trades, and paid for Superbowl ads. They drowned out each other. In a downturn, as companies slash their marketing budgets, a few dollars can buy significant mindshare.

4) Engage in Targeted, Strategic M&A Discussions

This is not the time to run a formal process unless you have to. However, this may be your window to put together a highly strategic, highly profitable M&A deal. In an active M&A market, buyers maintain a deal pipeline, relying on advisors to bring deal flow, and also seeking out proprietary deals by contacting sellers directly. Even when sellers are interested in engaging directly, the smart ones also engage advisors and explore all of their options. This is a best practice that protects the interests of shareholders and fulfills the fiduciary responsibilities of boards. However, in a down market the imperative to shop broadly is reduced, because buyers are less active, M&A interest is limited, and the downside risk of confidentiality breaches is amplified. In a bull market, the fact that you are considering offers for your company will be met with a shrug. In a global financial crisis, the fact that you are considering offers for your company implies that you are in deep trouble, and desperate for a lifeline. For shareholders and boards, this creates a scenario where M&A needs to be targeted, focused, and disciplined.

5) Embrace Your Partners

The tech economy is a web of dependencies, alliances, integrations, and informal alliances. Emerging companies that can operate under the umbrella of a larger partner, gain credibility and clout. For example, a tiny company selling cloud storage tools to enterprise customers will get little attention, but an tiny company whose product is offered by Amazon as a value add to their storage platform will gain instant acceptance. These relationships need to be protected and sustained. Customers are tightening budgets and cutting “risky” vendors. Alliances with giants can keep your product off the chopping block.

6) Put Revenue First

A CEO’s job is to keep fuel in the tank. Revenue is the best fuel. It is non-dilutive, it creates interaction with sources of more revenue (“land and expand”), it translates directly into enterprise value in an M&A or capital raise, and it validates your technology in the wild. Raising money to complete a new version may not be possible; selling the current version will drive value. Sales-oriented companies survive downturns. Companies that are manic and focused about sales emerge from downturns as market leaders. During the financial crisis of 2008, as an investor and board member of a security software startup, I helped organize phone-a-thons that put everyone in the company in sales, and paid out prize money for “most calls”, “most new customers”, etc. This is not a time to study spreadsheets. I guarantee that if you put everyone on the phone, you will discover sales talent in unexpected corners of your company.

7) Maintain Your Vision

You may have to allocate part of your dev team to professional services projects at a large customer, in order to temporarily shift payroll. That doesn’t mean you have to become a professional services company. You may lose the opportunity to splash down at a dozen industry conferences because they are all cancelled, but that doesn’t mean you should stop marketing. You may have to cut deep into your team, but that doesn’t mean you shouldn’t offer new incentives to the critical core of your company. Disrupted markets pull us in all directions; it takes hard work and focus to keep everyone moving toward your shared destination

8) Outsource, Acquire, Adapt

One of our clients was days away from signing a new lease in a city where they had just landed a significant customer when the “work from home” (WFH) mandates started to take hold. They invested in IT and processes to enable WFH, and are now more productive than ever, without a new real estate expense on their P&L. We are helping another client acquire a smaller competitor that has customers and infrastructure that our client could have pulled together on their own, but it will be faster and cheaper to buy those assets. Another client has delayed a CRM selection process, and is now fielding calls from competing vendors, all offering terms that are at least 30% below their prior pricing. In a robust market, expediency wins. In a disrupted market, it is important to take the extra time required to minimize expenses.

During the dot.com and the financial crisis of 2008, the financial downturn put a damper on M&A, but did not reduce the need for M&A. The result was a lot of pent up demand. Companies that executed well during the downturn reaped we acquired for strategic values early in the recovery.

Growing companies is hard in a normal environment. It just got harder. CEOs are reading about Shackleton and Scott, tightening their belts, and looking for opportunities in a chaotic environment. What we know for sure is that the actions you take today will have a huge impact on your trajectory during a recovery.