CHOOSING AN M&A ADVISOR – DUTIES, LIABILITIES AND BEST PRACTICES FOR BOARDS AND MANAGEMENT

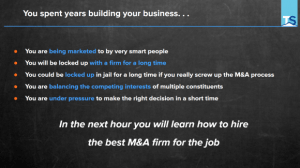

Certain corporate acts happen infrequently, but have a lasting impact. Hiring an M&A advisor typically occurs once in the life cycle of a company. Boards and management teams don’t get to practice and refine their approach – they have to get it right the first time.

Certain corporate acts happen infrequently, but have a lasting impact. Hiring an M&A advisor typically occurs once in the life cycle of a company. Boards and management teams don’t get to practice and refine their approach – they have to get it right the first time.

On November 15 TechStrat and SecureDocs will present a one hour webinar on the topic of Choosing an M&A Advisor. We will outline a process for identifying the right category of firm, based on your company profile and objectives. We will discuss the legal duties and liabilities of the board in connection with naming an advisor and executing a sale. We will cover the regulatory requirements for advisory firms. Most importantly, we will deliver the definitive playbook for managing the selection process: the agenda for advisor meetings, the questions to ask, the conclusions you should draw from the materials provided by advisor candidates. Finally, we will help you identify the seeds of success (or failure) in your early interactions with candidates.

Management, Boards and Shareholders are usually united in seeking maximum value for the company, but their interests are not aligned in other areas. Post-closing contingencies may benefit one group but not the others. Likewise, board members have a duty of care, and accountability for decisions, that will follow them for years, but will be irrelevant to management and shareholders. The TechStrat webinar will give practical advice for navigating these waters, based on experience on both sides of the table – as board members interviewing bankers, and as advisors pitching for business.

Please join us on November 15. If you are unable to join the live event, the webinar and “cheat sheet” will be available the day after the event.